ADVERTISER RESOURCES

ADVERTISER RESOURCES

ADVERTISER RESOURCES

ADVERTISER RESOURCES

OOH Traffic Analysis Update: Late April Driving Increasing

OVERVIEW

In mid to late April, provinces began announcing plans to reopen the economy by business sector, giving Canadians a sense of when Stay-at-Home (SAH) orders will begin lifting. Whether it’s this positive news from governments, the days of warmer weather or a new normal settling in, traffic passing by our OOH displays is increasing as we approach May.

PATTISON’s granular traffic data of mobile devices passing by 24,000 geofenced displays showed a sharp decline in the early weeks following emergency SAH measures which was then followed by a period of plateauing. As of April 26, traffic has been increasing back towards normal levels and looking to Apple mobile driving data which is one week ahead, the upward trajectory continues.

3 KEY TAKEAWAYS

1. As of April 26, traffic passing by PATTISON’s OOH displays has increased to 50% or more of normal levels. Indications are that this pattern of more driving taking place on our roadways will continue.

2. Apple’s mobile data on Canadians driving is used to supplement PATTISON’s data and shows that as of May 2, traffic on roadways is 65% of normal. Given how closely our data mirrored Apple’s, we project our reporting to follow the same upwards trajectory in the coming week.

3. The predominant factor for Canadians driving continues to be shopping for household purchases at grocery, home & garden and pharmacy retailers. Unlike other countries during the lockdown, Canadians have not adopted online buying to a significant degree as reported by McKinsey. One reason cited was few online options. This presents an opportunity for Canadian businesses to publicize their online offerings on OOH displays as Canadians may not be aware, especially if it’s a new feature in response to COVID-19.

“Canadians have not experienced a major shopping shift to online channels; in fact, they expect to shop less online for several key categories, possibly a symptom of low online adoption and fewer online options.”

Source: McKinsey & Company, COVID-19 Canada Pulse Survey; April 21-23

Canadians have however, made notable changes from their pre-lockdown shopping behaviour by trying new brands, changing their primary grocery

store or trying a new grocery store altogether with many indicating their intent to continue to do so.

Reporting

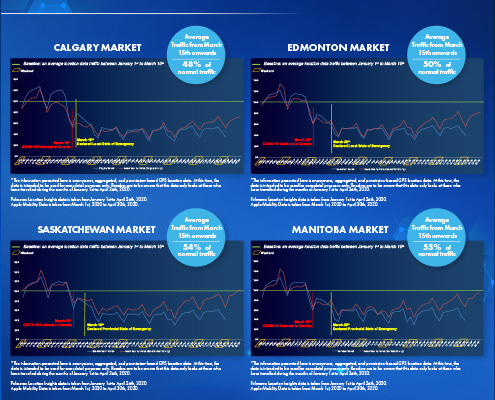

- Traffic is steadily increasing with most markets over 50% of normal

| PATTISON Markets | % of Normal Traffic (Average Traffic from March 15th Onwards) |

| Vancouver | 52% |

| BC Interior | 71% |

| Calgary | 48% |

| Edmonton | 50% |

| Saskatchewan | 54% |

| Manitoba | 55% |

| Toronto | 46% |

| Southwestern Ontario | 55% |

| Ottawa | 49% |

| Montréal | 42% |

| New Brunswick | 55% |

| Nova Scotia | 51% |

| Newfoundland and Labrador | 58% |

To view all regional findings, click to download the full PDF version of the report here.